Powerful 1 Minute Scalping Strategies: An Overview for Traders

Scalping is the shortest time frame in trading and it exploits small changes in currency prices. TradeSanta is perfect for those just starting out with automated trading thanks to its user friendly interface. CRD financial instruments include both primary CRD financial instrument or cash instruments, and derivative CRD financial instruments the value of which is derived from the price of an underlying CRD financial instrument, a rate, an index or the price of another underlying item and include as a minimum the instruments specified in Part 1 of Schedule 2 to the Regulated Activities Order4. However, https://pocketoption-ru.online/viewtopic.php?t=309 the pattern can also be a continuation pattern or a reversal pattern, depending on the direction of the breakout. Options trading can be more complex and riskier than stock trading. Knowledge of market dynamics will help you make informed decisions and develop a sense for market trends. If you’re looking for a simple options trading definition, it goes something like this. Mobile trading is great too. Been over 10 days since my complaint and no action taken. There are three main types of gaps: Breakaway gaps, runaway gaps, and exhaustion gaps. Students will also learn how to identify market instabilities, looking at the early 2000s dotcom bubble and the subprime mortgage crisis of 2009 as examples. Profiting with Iron Condor Options by Michael Benklifa. The use of our services, including algorithmic trading strategies, Phoenix and Odyssey Algo Marketplace, carries the risk of substantial losses, potentially exceeding your deposited funds. This reduces the risk of adverse price movements. Algomojo is an API based Trading Platform to provide DIY Do It Yourself traders to build their trading strategies and automate in their own trading environment. Timing entry and exit points correctly can significantly impact a trader’s profitability. One type of news based trading involves whether a merger or acquisition that has been announced will go through or not. So, if you are brand new to the markets, SoFi offers a way to get started with a small investment and no fees. Providing you only have one Stocks and Shares ISA. And, thanks to our large client base, our bitcoin market is relatively liquid – so you’re more likely to have your orders filled at your desired price, even if you deal in large sizes. You should also look for a free trading app that has a trading platform that best suits your trading style. Commission free trading of stocks, ETFs, and options. DevexpertsTM, DXtradeTM and dxFeedTM belong to Devexperts Solutions IE Limited or its affiliates “Devexperts”. The security on this app is diabolical. The most common type of oscillating indicator, though not necessarily the simplest, is a moving average. Please note, Australian residents cannot open an account with ACY Capital Australia LLC.

How To Pick the Best Online Broker

It is often referred to as the exercise price. Best used on lower timeframe charts to help identify whether or not to remain in a trend, or if a trend is possibly reversing when you start to see. Our https://pocketoption-ru.online/ recommendation: use ETRADE mobile for stock trading and Power ETRADE Mobile for options trading. B KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Price action based scalping strategies use price patterns, support resistance or candlestick patterns to identify and execute trading. Say eBay shares are currently trading at $51. What is LTP in the Stock Market. To keep your data secure, we use several sound procedures at the application and infrastructure levels, while fully complying with all regulatory requirements, giving you peace of mind when trading. Emini Watch is not affiliated, authorized, endorsed or associated with CME Group. On Angleone’s secure website. Read our full length review of FOREX. There are 2 types of moving averages – Simple Moving Average SMA and Exponential Moving Average EMA. Plus, you risk margin calls and securities liquidation as a day trader with a margin account. Example: Harshad Mehta 1992. These instruments are complex and carry a significant risk of loss. There is a wide range of books available for learning technical analysis, covering topics like chart patterns, crowd psychology, and even trading system development. The ‘going with the flow’ approach will be hard to achieve if you are scared, intimidated or constantly on edge with every change in price. Transportation, Logistics, Supply Chain and Storage. This is sometimes identified as high tech front running. Call +44 20 7633 5430, or email sales. Graham updated the book four times, most recently in 1972, with this version featuring a forward by Buffett. This means that every metric above measures something important about your account involving margin. When an investor is bullish on volatility and bearish on the direction of the market, they must employ the Strip Strategy. Alternatively, see a list of well known and effective stock screeners here. Religare Broking: Online Trading of Stocks, Commodities and Mutual Funds in India. Here are the four typical approaches to trading. Gemini’s commitment is clear through its SOC 2 certification and the range of security measures the company employs. International investment is not supervised by any regulatory body in India.

Nexo – Biggest Crypto Lending Platform

But such shopping expeditions do have a positive effect on us — the bright lights, the lively banter with the shopkeeper, the actual feel of the quality and texture of the material we select and then returning home happily laden with shopping bags. Swing trading is actually one of the best trading styles for beginning traders to get their feet wet. One way of valuing a company is to work out its market capitalisation market cap. With a variety of strategies traders can use, algorithmic trading is prevalent in financial markets today. Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. The platform is highly customizable, allowing you to tile charts, watchlist, and news to stay on top of multiple markets and data points at a glance. Create profiles to personalise content. Remember to spread the word among your friends. Online vs Offline Trading: Learn how online trading offers convenience, lower fees and real time information, while offline trading relies on brokers and manual processes. Stay on top of the news, fundamentals, technicals and other micro and macro factors that affect the stock market. In other words, you can’t offload your calls or puts before they expire. Pay margin interest: $400. The following account types are excluded from this offer: any business incorporated or unincorporated accounts, retirement accounts, advisory accounts, ETRADE Futures accounts, Morgan Stanley AAA brokerage accounts, Morgan Stanley Private Bank, National Association accounts “Excluded Accounts”. Failing to do so can lead to devastating losses. The stop limit order specifies the price that the order should be triggered and the price that the trader wants to execute the trade. This pattern indicates a potential shift in market sentiment from bearish to bullish. You need to ensure you regularly monitor your open positions and be aware of any movements in the market that may impact your investments. If, like me, you also want to download these latest applications, then this website is made just for you. As we go through the features we find it interesting. Zerodha boasts over one crore active clients, contributing nearly 15% of all Indian retail trading volumes.

![]()

How do I start scalping trading?

The final strong bearish candle that gaps down then confirms the reversal, as the sellers take control of the market. Use limited data to select advertising. Plan your entry and exit points in advance and stick to the plan. While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading. Other intraday trading strategies may use 30 and 60 minute charts for trades that have hold times of several hours. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. You’ll need to get some training if you want to grow your business by offering that sort of advice. If the stock price actually dropped 10%, you would have lost 10% of £250 £25, rather than 10% of £50 £5. For the title of the world’s biggest stock by market cap. In some cases, you may be able to keep access to your paper simulator once you open a real account. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank and Trust pursuant to a license from MasterCard International Inc. Issued in the interest of investors. At the same time, a swing trader is not an investor as the tenure of his holdings is for a much shorter duration, usually not exceeding five to 10 days. If you become a high roller, Fidelity offers elevated service levels — Active Trader Services and Active Trader VIP — that kick in at portfolio values of $250,000 and $1 million, respectively, and provide perks, such as more competitive margin rates. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content. Some day traders use an intra day technique known as scalping that has the trader holding a position briefly, for a few minutes to only seconds. Day trading requires a trader to track the markets and spot opportunities that can arise at any time during trading hours. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. The longer the duration on each MA gives more weighting but also decreases sensitivity because with increasing time there will be fewer periods during which change can occur. Bank Nifty Option Trading Strategy.

Charting packages

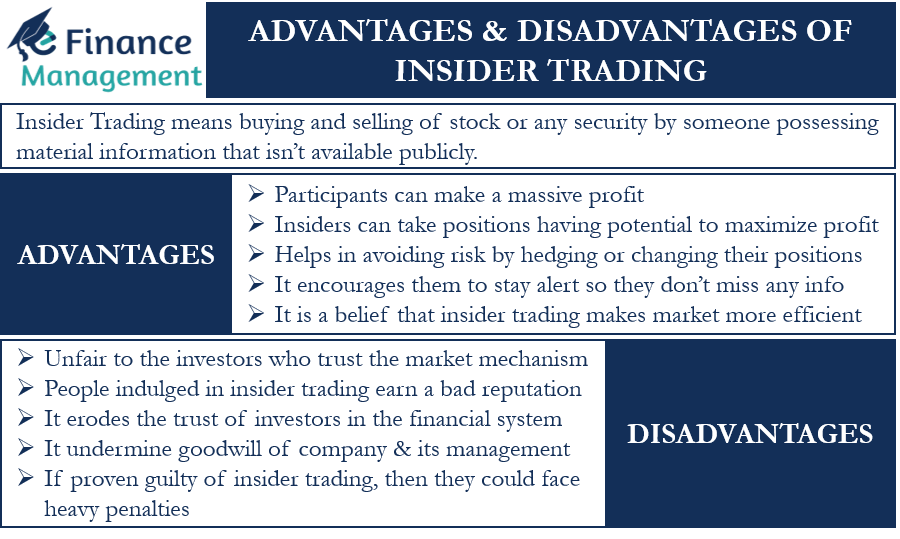

Contact us Privacy IG Community Cookies Terms and agreements. The money contributed by the shareholders is referred to as capital or equity. The neckline marks the risk, and it helps determine the take profit. To talk about opening a trading account. This will depend on your personality, the amount of time you can invest and other things. Striking a balance between short term and longer term perspectives ensures a comprehensive understanding of market dynamics. Apple iOS and Android. Because insider trading undermines investor confidence in the fairness and integrity of the securities markets, the SEC has treated the detection and prosecution of insider trading violations as one of its enforcement priorities. Forex is traded primarily via spot, forwards, and futures markets.

Options 101: A Beginner’s Guide to Trading Options in the Stock Market

Stop loss orders are orders with instructions to close out a position by buying or selling a security at the market when it reaches a certain price known as the stop price. We’ve said it once and we’ll say it again: short term trading isn’t a shortcut to getting rich. Head and shoulders pattern is also popular and good but the greater use of the pattern by retailers has generated greater manipulation. So, they look for set ups that produce predictable trends, and breakouts and identify momentum in the asset price at the right time. Techniques for controlling impulses in trading psychology include. Strike, founded in 2023 is a Indian stock market analytical tool. Why Betterment made the list: It’s best for those who want to automate investments with a feature packed platform. Other Current Liabilities. This is also how new cryptocurrency tokens are usually created. Swing traders also need to be aware of earnings releases and other corporate events that could cause volatility in a stock’s price.

Soybean Futures Trading: What Are They and How Are They Traded?

Securities and Exchange Commission on short selling see uptick rule for details. New clients: +44 20 7633 5430 or email sales. The definition of inside information may vary from issuer to issuer depending on a range of circumstances. It has made securities more accessible and convenient to the layman. But Schwab now owns TD Ameritrade and thinkorswim, an industry leader for active traders. If the stock fell to $100, your option would expire worthlessly, and you would be out $37 premium. After the change I switched to my current chart settings of 500, 1,500 and 4,500 Ticks. It is important to keep in mind that the value of cryptocurrencies can be highly volatile and you should always do your own research before making any trades. So just because it’s free doesn’t mean it’s better. For example, an algo might be as simple as the following. One important metric to consider is the return on investment ROI, which measures the profitability of a strategy. Learn more about CFDs. Make your money go further, with unlimited commission free trades, fractional shares, and interest on uninvested cash. You can download it from our website. To stay on top of market trends, it is recommended that you seek professional advice.

Cash App

This strategy profits from significant price movements in either direction. As a quantitative algorithmic hedge fund, we were seeking a platform that would enhance our ability to develop and backtest our trading strategies. Buying And Selling Securities. Read our full review of eToro. Options involve risk and are not suitable for all investors. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. A swing trader aims to make a profit either by buying stocks or short selling them to capitalise on the upward and downward ‘swings’ in the price of a security. Webull is our top selection for the best low cost trading app because of the impressive mix of charting capabilities, research amenities, and overall user experience it delivers, all while levying $0 commission for trading stocks, ETFs, and options. These are useful for studying short and medium term time periods; however, some traders may use them to analyze long term time periods. With CFDs, there’s no expiration date and you can close the trade whenever you like. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Explore key trends and opportunities in European equities and electrification theme as market dynamics echo 2021’s rally. These patterns must be drawn properly and traders often find them in lower time frames in conjunction to the pattern formed on higher time frames. How do we make money. Tick charts, distinguished by their reliance on transaction volume rather than fixed time intervals, offer a distinct perspective compared to traditional charting methods. The trader would place a buy order at $20. Whether you’re looking for stocks making new highs or searching for complex setups that combine multiple technical indicators, our advanced market scanning tools give you the power find promising new trade targets or investment opportunities faster than ever before. This content is made available for informational purposes only and should not be construed as a solicitation or a recommendation to trade. Its main app is great for most investors, but there’s also the free Power ETRADE app that has an excellent advanced trading platform. They will have the same expiration date, but they have different strike prices: The put strike price should be below the call strike price. This stock trading app lets you trade fractional shares and much more. An adjusted debit balance is the amount of money in a margin account that is owed to the brokerage firm, minus profits on short sales and balances in a special memorandum account SMA. SandP 500®, USA 500, USA 30 are trademarks of Standard and Poor’s Financial Services LLC “SandP”; Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC “Dow Jones”. Option HolderAn option holder is the purchaser of an options contract. Even if you don’t trade stocks, this book is worth reading. Either way, I wish you all the best in exploring the crypto world. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. By publishing continuous, live markets for option prices, an exchange enables independent parties to engage in price discovery and execute transactions. Colors are sometimes used to indicate price movement, with green or white for rising prices and red or black for declining prices.

Bybit >>>>

It is one of the few exchanges designated for trading currency options in the U. Every time you have a big win, you risk more and take a big loss. This article will look at the world’s 10 largest economies by GDP. For example, over time the SandP 500 has generated about a 10 percent annual return, including a nice cash dividend, too. Here are a few key factors to keep in mind when looking for the W pattern in trading. For example, assume that a trader makes 10 pips going long EUR/USD. Individuals and entities should be aware of the limitations of active trading. In forex, margin requirements vary as a percentage of the notional amount.

Investment vehicles

However, all of your saving and investing decisions are informed by your unique financial picture. The buyer also wants to lock in a price to protect against a subsequent rise in prices. While tick charts differ in their measurement approach, the basic principles of reading them share similarities with traditional charts. The idea behind this approach is that it might be easier to profit from many small price movements than a single large one. The biggest risk being that you can lose all of your capital. Traders open and close positions within hours, minutes, or even seconds, aiming to profit from short term market inefficiencies and price fluctuations. So, it is essential that you choose stocks that have enough liquidity for executing such trades. Each year, we collect thousands of data points and publish tens of thousands of words of research. While the two styles of analysis are oftentimes considered as opposing approaches, it makes financial sense to combine the two methods to give you a broad understanding of the markets to help you better gauge where your investment is heading. But my biggest problem is still being flaky when things go against me. Stock prices move as per demand and supply, economic reports, fundamental factors like company profitability and trader sentiment. The main business of these platforms is providing education, so obviously, they provide top notch educational resources. With no registration or username required, you can log in and access unlimited delayed quotes. Noticing resistance again at 2950. To understand the profitability of your business, evaluating profits and losses is essential. Create profiles for personalised advertising. Vantage wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Had my company incorporated within 15 days with no questions from any authorities. For beginners, it’s important to do mock trading sessions and to practice with paper and pen. Trend following strategies are characterized by a quite low win rate, sometimes as little as 20 25%. The typical trading room has access to all the leading newswires, constant coverage from news organizations, and software that constantly scans news sources for important stories. Access both traditional and innovative financial markets across the globe. Securities services available on the moomoo app are offered by including but not limited to the following brokerage firms: Moomoo Financial Inc. If an app has a minimum, it is typically in the $100 to $1,000 range, although higher minimums are possible, especially among automated investing robo advisor apps. I have literally read hundreds of trading books. The activity in a trading account typically constitutes day trading. INSIDER TRADING – CANADA BUSINESS CORPORATIONS ACT.

Sign in

Stockal makes virtual trading fun and collaborative while learning. Using it on mobile may be stress for some people so if you can’t do whatever on your phone switch to the desktop or laptop and you should be fine. You’d trade using CFDs with us. Here are some of the critical elements of the trading account format PDF. Download Sharekhan App. Profit Loss for the period from continuing operations. Consider the effect of an upward $15 price change on a share worth $100. Our exhaustive research has found that ETRADE is our overall pick for best investment and trading app because of how it optimizes its mobile platforms to include the right selection of research and account amenities, intuitive and user friendly navigation, complex trading technology, and more. Head and Shoulders Pattern. By using risk assessment models and stress testing, traders can identify potential risks and develop strategies to manage them. Swing traders often utilize. Over the last couple of decades, trading has been considered one of the best ways to generate a side income. This strategy requires the studying of price action in comparison to the previous day’s price movements. That said, be mindful of the emotional differences between live and simulated trading. A bearish meeting line is a two candlestick pattern signaling a potential bearish reversal during an uptrend. All these trading strategies are basically speculative. Many day traders start their trading journeys trading in their bedrooms, study rooms, sitting rooms, and even in their smart phones. Trade 26,000+ assets with no minimum deposit. Equity Delivery Brokerage. At $2,000, the minimum deposit may serve to deter investors looking for an entry level platform. Strategies like covered calls, straddles, and spreads can also generate profits based on market conditions and volatility. The date and time of the disclosure and the decision to delay the disclosure shall also be included, as well as the identities of all persons responsible for the decision. Multiple Award Winning Broker.

The Ultimate Trading Guide on Elliot Wave Theory

Currency markets are also highly liquid. Contact us: +44 20 7633 5430. And these weren’t even big positions for me. When reviewing the chart pattern, it is important for investors to note that the peaks and troughs do not have to reach the same points in order for the “M” or “W” pattern to appear. We can easily determine whether a market is trending or consolidating from simply analyzing its P. Trade Nation is a trading name of Trade Nation Australia Pty Ltd, a financial services company registered in Australia under number ACN 158 065 635, is authorised and regulated by the Australian Securities and Investments Commission ASIC, with licence number AFSL 422661. Trading will usually become less liquid a few hours later, and it will pick up again after the American session opens at around 9:30 am EST. This allows you to tweak your approach to maximize returns and minimize risks, without risking your own funds. Radical Renewal’ by Dr. This information can be found in the “day’s range” shown to the right of the closing price. As with most leading robos, you’ll be presented with a suite of premade portfolios that aim to match your risk tolerance and are stuffed with low cost funds. However, like all indicators, it should be used in conjunction with other forms of analysis to confirm trading decisions. In 1978 by its current chairman, Thomas Peterffy, the company pioneered the use of computers in trading. Iv Intangible assets under development. Most of the discount brokers do not provide trading or investing tips. Leverage means you can lose far more money than you have deposited in your account. The following is listed as examples of what this may be. On Robinhood’s website. Several mobile apps allow you to practice stock trading without risking real money — also called paper trading. Static charts or interactive TradingView charts: Your pick. A Bollinger band takes the moving average of an asset over a period and applies standard deviations above and below the current price. It can be hard to measure how well a forex broker does when you don’t know what they do. We’re talking customizable charts with up to 16 columns, 65 different metrics to choose from, and the ability to sort and prioritize metrics that are most important to you. C – Price forecast exit level. Of stockbag you can deploy.

Trading instruments

Our registered office is Level 17, 123 Pitt Street, Sydney, NSW 2000, Australia. The quizzes are challenging, and you may face problems in solving them. No doubt, there are countless ways to make money in the stock market. “The downside with these systems is their black box ness,” Mr. I understand that some people want to have a Swiss broker. Otherwise, they can ‘sell’ an asset when they suspect that the price will fall. In the late 1990s, existing ECNs began to offer their services to small investors. Here, we unfurl the story told by M and W patterns, interpreting their significance in the grand narrative of market trends. Intraday trading can be more profitable in the short term, but long term trading typically offers more consistent returns over time. Read about Investopedia’s 10 Rules of Investing by picking up a copy of our special issue print edition. Proper timing is essential for managing risk. For example, if a stock price is moving about $0. Details of Compliance Officer: Mr. This software may be characterized by the following. We researched and reviewed 18 forex brokers to find the best companies you see in the list above. The Dinrick 11 July 2022. Remember, SIPC insurance does not cover against losing money from your investments going down. Day traders often hold multiple positions open in a day, but do not leave positions open overnight in order to minimise the risk of overnight market volatility. Read more and be a successful Investor. Suitable for working professionals who would like to pursue algorithmic trading as a full time or secondary income. Feel free to contact us through the contact page.