Contents

75% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Therefore, the calculation of the trading volume is regulated by the SEC. Volume of trade, also known as trading volume, refers to the quantity of shares or contracts that belongs to a given security traded on a daily basis.

Determine significant support and resistance levels with the help of pivot points. Learn how to trade forex in a fun and easy-to-understand format. Lastly, price is known to precede volume and if closely monitored, it helps one form ideas regarding trend reversals.

https://forex-trend.net/ volume in a downtrend may indicate increasing sell pressure. On Balance Volume is another indicator that incorporates volume. OBV tries to detect momentum by providing a running total of volume, showing when volume is flowing into or out of a stock or other security. An upward-sloping OBV would be used to confirm an uptrend, while a downward-sloping OBV might confirm a downtrend. Both OBV and the ARMS Index are available in Active Trader Pro®. Learn how to interpret a stock chart to understand the movement of the stock market and an individual stock’s performance, as well as how to make sound financial decisions.

Any liquid asset’s average daily trading volume indicates how the price has changed over time . Increasing volume usually serves as confirmation for a breakout in range-bound asset prices. Volume is counted as the total number of shares that are actually traded during the trading day or specified set period of time.

Stock Volume

When the price breaks below a support level, the breakdown is generally believed to be more significant if volume is high or above average. A breakout accompanied by low volume suggests enthusiasm is lacking. An uptrend without increasing and/or above average volume suggests investor enthusiasm is limited. While the price could continue to rise, many traders who use volume analysis will nevertheless look for other candidates.

The Klinger oscillator compares https://topforexnews.org/ to price, and is designed to identify possible price reversals. A bullish signal may occur when the volume moves up on a price downturn, then the price rises and falls again. If the downturn doesn’t fall below the previous low and the volume drops on the second downturn, it may be considered a bullish indicator.

Similarly, the https://en.forexbrokerslist.site/ of trade reported at the end of a trading day is also an estimate. The actual figures are not made available until the following day. Trading volume, or volume in trading, is the number of completed trades in a single security or across a whole market in a given time period. For example, if shares in a security are traded 50 times in a day, the volume for the day is 50. Volume refers to the amount of shares or contracts traded in an asset or security over a period of time, usually over the course of a trading day. Each market exchange tracks its trading volume and provides volume data.

However, there are other ways that traders can determine market volume, such as the tick volume or number of price changes. If the market price is changing rapidly, it can be an indicator of high trading volume. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. All the market exchanges track this data and present the volume data. The volume of the trade numbers is reported hourly throughout the entire trading day.

JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. The volume of trade is used as a measure of liquidity and activity. Higher trading volumes are considered more positive than lower trading volumes because they mean more liquidity and better order execution.

Volume (finance)

Learning how to identify volume trends is exciting especially if you are patient and devoted to be a full time trader. With practice, it can give a trader or investor a huge advantage. Confused volume – in day trading, it refers to an algorithm which helps to identify places where ask, bid and downside are happening. Confused volume is an important indicator which helps to show changes occurring to trends. In a head and shoulders pattern, volume usually decreases with each successive peak.

- The average can be calculated over any number of days, and is useful for determining which stocks are suitable for which investors/traders.

- When securities are more actively traded, their trade volume is high, and when securities are less actively traded, their trade volume is low.

- If a stock is rising on low volume, it may simply reflect an absence of sellers.

The average daily trading volume could be determined over any time frame, such as the last five or ten days. The average trading volume over a period of 20 or 30 days, one quarter, six months, or a year is a typically used ADTV measure. The average daily trading volume is a key indicator since various investors and traders are drawn to markets with high or low trading volumes. Due to the ease of entering and exiting positions with high-volume trading, numerous investors and traders choose it over low-volume trading.

For example, analyzing trends in volume can help you validate patterns if you are an active investor that incorporates charts and trends into your strategy. Technical analysts believe that volume precedes price; to confirm any trend, volume should increase in the direction of the trend. Investors can make an assessment of how convicted traders are about a particular stock, or the market in general. High volumes indicate a strong conviction with the direction in which the stock or market is moving.

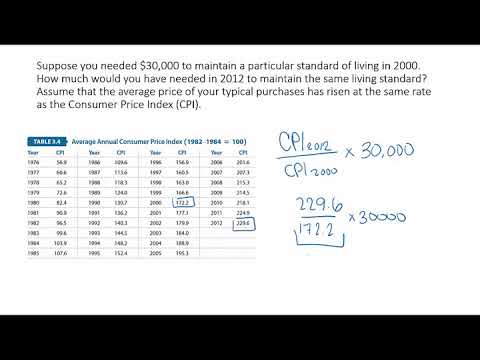

The method for determining trading volume is called volume counting. In the United States, the SEC determines the methodology of volume counting. A significant change in how people value or perceive the asset is indicated by a sharp rise or fall in average daily trading volume .

Volume definition

She produced the morning news programs for the NBC affiliates in Evansville, Indiana and Huntsville, Alabama and spent a short time at the CBS affiliate in Huntsville. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. IG International Limited receives services from other members of the IG Group including IG Markets Limited.

While swings in trading volume may not be enough on their own to reveal changes in a trend, they can give you a sense of how much strength there is behind a move. An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline. The pattern is considered a continuation pattern, with the breakout from the pattern typically occurring in the direction of the overall trend. Volume is the number of shares of a security traded during a given period of time. These volume reports usually come once an hour, but they are only estimates – for accurate volume figures traders have to wait until the end of the day.

What does Average Daily Trading Volume (ADTV) mean?

Historical or hypothetical performance results are presented for illustrative purposes only. As discussed, liquidity offers the ability to buy and sell stocks easily. When more investors are trading in high volumes, it’s easier to liquidate the stock. Volume allows investors to chart a stock’s trading activity over time and identify its strength or weakness. Stock volume is the number of shares traded over a period of time .

This is especially true for large stock traders and fund managers. High frequency trading programs and smart algorithms detects large orders and can possibly front run the orders causing traders to chase entries and exits. Volume can be a helpful piece of information in the trading process.

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. A downtrend accompanied by increasing and/or above average volume implies investors have doubts about the stock, which could lead to more selling and even lower prices.

Stocks with low volumes can be difficult to sell because there may be little buying interest. Additionally, low-volume stocks can be quite volatile because the spread between the ask and bid price tends to be wider. When considering volume while evaluating a particular stock, investors might want to assess how difficult it could be to dispose of their shares if they decide to sell. Different conclusions can usually be drawn from low trading volume. If a stock is rising on low volume, it may simply reflect an absence of sellers. And if a stock is declining on low volume, it might mean there are very few bids.

For example, if bitcoin jumps 20% in one trading day after being in a long downtrend. If the volume is high during the day relative to the average daily volume, it is a sign that it is reversing its trend. The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy. Day Trading is a high risk activity and can result in the loss of your entire investment.